Predicting a company's financial future isn't crystal ball gazing; it's a blend of data analysis and informed judgment. Next Twelve Months (NTM) projections are crucial tools for investors, analysts, and executives alike, offering a forward-looking perspective on a company's performance. This guide will equip you with the knowledge and actionable steps to effectively leverage NTM data for informed decision-making. Understanding NTM projections is key to navigating the complexities of financial forecasting and making strategic choices for growth.

Understanding NTM Projections: A Forward-Looking Lens

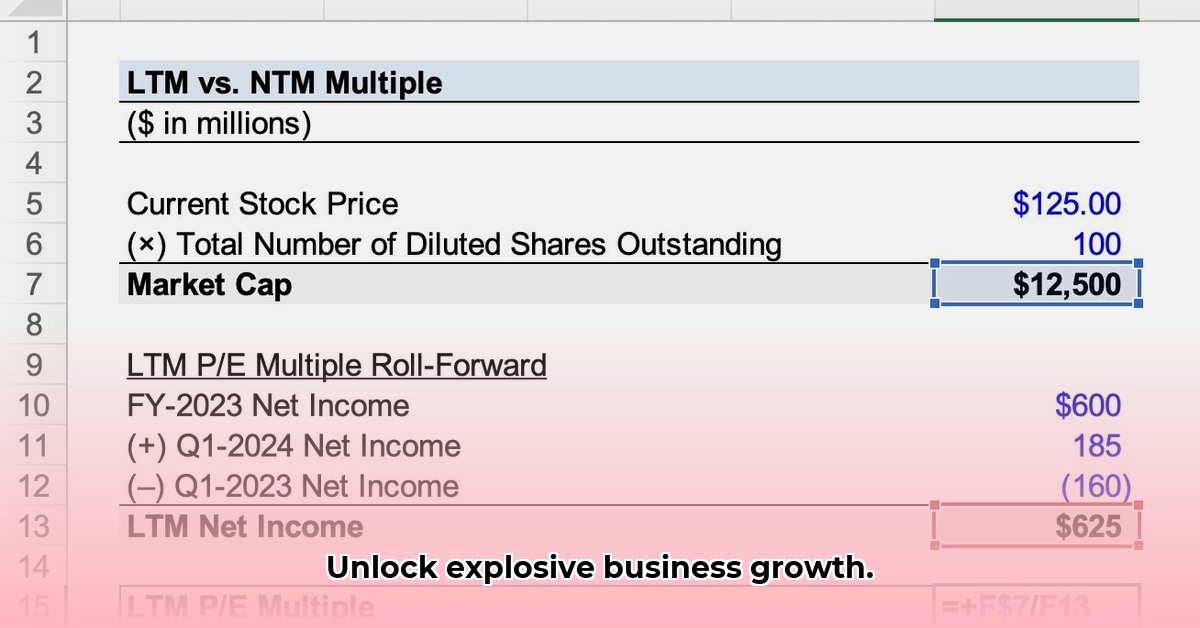

NTM, or Next Twelve Months, projections forecast a company's financial performance over the next year. Unlike historical data like Last Twelve Months (LTM) figures, which reflect past performance, NTM provides a forward-looking view—essential for assessing future potential and risk. This forward-looking assessment is critical for assessing investment opportunities, guiding strategic business decisions and accurately valuing companies. However, the accuracy of NTM projections depends on the reliability of the underlying assumptions and forecasts.

But how do NTM projections differ from using last year's data? Isn't that enough? Isn't the past a good indicator of the future? While LTM data provides valuable context, relying solely on it can be misleading, particularly for fast-growing companies undergoing significant transformations. NTM offers a more dynamic view, capturing the momentum and anticipated changes crucial for accurate evaluation.

Making Sense of NTM Data: A Step-by-Step Approach

Creating reliable NTM projections isn't simply plugging numbers into a formula; it requires a comprehensive understanding of the target company, its industry, and the broader economic environment. Here's a structured approach:

Industry Analysis: Begin by thoroughly researching the company's industry. Is it experiencing growth, stagnation, or decline? This context is crucial for interpreting NTM figures such as EV/NTM EBITDA ratios. A high valuation in a rapidly growing sector might be positive, while the same valuation in a declining sector raises significant concerns.

Benchmarking: Compare the company's projected NTM performance to its competitors. This comparative analysis provides valuable perspective – is it outperforming, underperforming, or in line with industry peers? Are there any significant differences to investigate? This analysis ensures the projections are grounded in realistic industry comparisons.

Qualitative Factors: Don't overlook qualitative factors. Assess the quality of the management team, potential regulatory changes, emerging technologies, and evolving consumer preferences. These qualitative inputs critically impact the accuracy of financial projections.

Scenario Planning: Construct multiple NTM scenarios. This forward-thinking approach allows you to incorporate various economic conditions and unexpected events (e.g., changes in interest rates). These scenarios allow for a broader range of outcomes, making your projections more robust and better equipped to deal with uncertainty.

Dynamic Forecasting: Regularly review and update your NTM projections as new information emerges. Market conditions are dynamic; these adjustments are vital to maintain relevance and accuracy. This ensures the projections remain timely and relevant, reflecting the latest market intelligence.

Who Uses NTM Projections?

NTM projections are versatile tools used by a wide range of stakeholders:

- Investors: Use NTM to assess investment risks and potential returns, guiding buy-sell decisions. Investing in a company is a vote of confidence in its future prospects; this is where NTM plays a vital role.

- Financial Analysts: Employ NTM in valuation models, identify opportunities and potential challenges, and offer comprehensive client advice. Analysts play a critical role in translating complex financial data into actionable insights.

- Company Management: Use NTM to direct strategic decisions, allocate resources, define growth targets, and monitor overall performance. These projections guide internal decision-making towards operational efficiency and sustainable growth.

- Regulators: Use NTM to monitor financial reporting, ensure accuracy, and maintain market stability. Regulatory bodies require transparent and accurate financial reporting, and NTM assists in maintaining this standard.

Addressing Potential Pitfalls

Despite its value, relying solely on NTM projections has limitations:

Overconfidence: NTM projections are estimates, not guarantees. Overconfidence can lead to unrealistic expectations and poor risk management.

Flawed Assumptions: Inaccurate initial assumptions lead to unreliable projections. Careful research and validation of assumptions are crucial for accurate forecasting.

Ignoring Context: Focusing solely on the numbers without considering relevant qualitative factors (market trends, regulatory changes) can lead to inaccurate conclusions.

Mastering NTM: A Balanced Approach

Mastering NTM finance isn't just about numerical proficiency; it's about integrating data with sound judgment. By combining historical data, industry trends, and forward-looking insights, you can create significantly more reliable projections. It's about striking a balance between quantitative analysis and qualitative understanding. The key takeaway is to embrace the uncertainty inherent in forecasting and to adapt your approach accordingly. Regular monitoring and adjustments are essential to keep your NTM projections relevant and useful.